The rollout of IRDAI 1600 series insurance calls is one of the most practical anti-fraud moves Indian consumers have seen in years. Insurance scams don’t usually start with hacking—they start with a phone call that sounds official. The new rule narrows that attack surface by standardizing how insurers contact customers. If you know what the rule does (and doesn’t do), you can shut down most scam attempts in seconds.

This isn’t about memorizing helpline numbers. It’s about pattern recognition—knowing what a genuine call looks like so the fake ones stand out immediately.

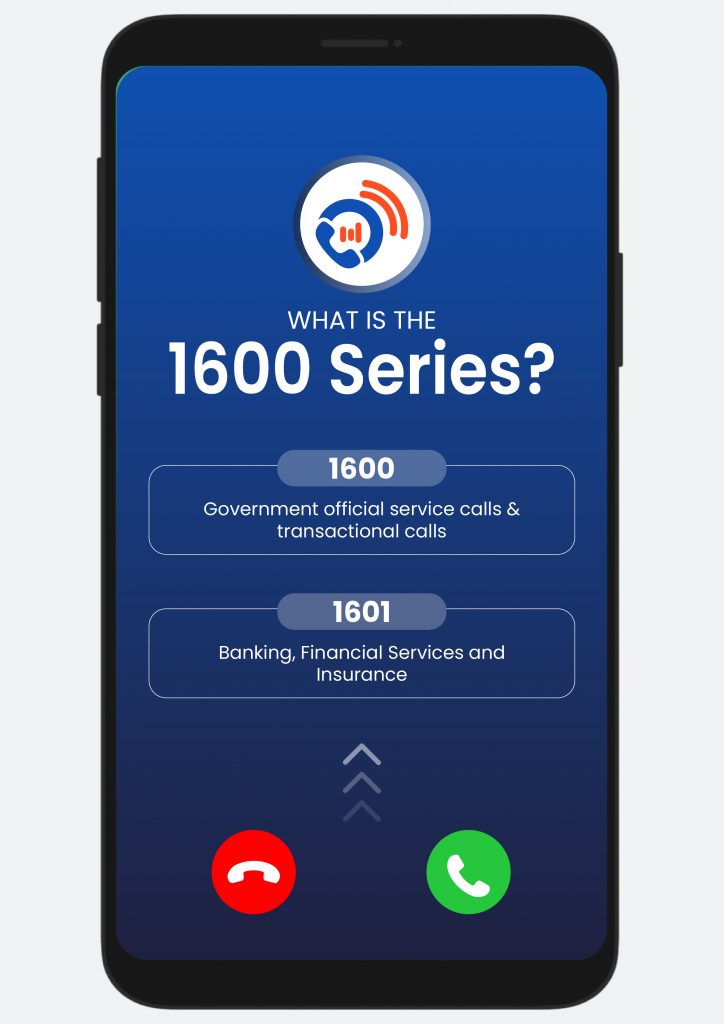

What the 1600-Series Rule Actually Means

Under the new framework, insurers must use 1600-series numbers for outbound customer calls related to policies, renewals, claims, and servicing.

In plain terms:

-

Legitimate insurers call from 1600-xxx-xxxx numbers

-

Random mobile or international numbers are suspect

-

The number range becomes a verified signal, not a guarantee

The goal is customer safety, not convenience.

Why IRDAI Introduced the 1600-Series

Scam volumes exploded because spoofed mobile numbers were easy to rotate and hard to trace. The regulator stepped in to reduce ambiguity.

The IRDAI 1600 series insurance calls rule targets:

-

Caller ID spoofing

-

Fake “policy expiry” threats

-

Refund and bonus scams

-

Impersonation of agents

Standardization makes abnormal calls obvious.

Fraud relies on confusion. The 1600-series reduces it.

Here’s how scam prevention improves:

-

One expected number pattern

-

Easier blocking of non-compliant callers

-

Faster consumer judgment during calls

-

Clear audit trails for insurers

Scammers now have to explain why they’re not calling from a 1600 number—most hang up when challenged.

What Genuine Insurance Calls Will (and Won’t) Ask

Knowing the limits matters.

Genuine calls may:

-

Confirm basic policy details

-

Inform about renewals or service updates

-

Direct you to official portals

They will not:

-

Ask for OTPs or full card details

-

Demand urgent payments on a call

-

Threaten policy cancellation within minutes

If pressure tactics appear, the number doesn’t matter—end the call.

How to Verify a 1600 Call in Seconds

Treat the number as a first filter, not final proof.

Quick verification steps:

-

Check if it’s a 1600-series number

-

Ask for the insurer name and purpose

-

Hang up and call the official helpline yourself

-

Cross-check inside the insurer’s app/portal

This flips control back to you.

What If an Insurer Calls From a Non-1600 Number?

Transitions aren’t always clean—but caution still applies.

If a call comes from a different number:

-

Don’t share any sensitive info

-

Ask for written communication instead

-

Verify through official channels

Legitimate insurers will never object to verification.

How Scammers Will Try to Adapt

Expect evolution—not disappearance.

Likely scam shifts:

-

Fake SMS claiming “missed 1600 call”

-

Social engineering to move you to WhatsApp

-

Requests to “confirm” details elsewhere

The IRDAI 1600 series insurance calls rule blocks the first door. Don’t open the next one.

What This Means for Customer Safety Long-Term

Standardized calling improves:

-

Trust signals

-

Call traceability

-

Complaint investigation

-

Accountability across insurers

It doesn’t end scams—but it lowers their success rate sharply.

What You Should Do Right Now

Simple habits make the rule effective:

-

Save official insurer helplines

-

Don’t act on urgency created over calls

-

Never share OTPs—ever

-

Report suspicious calls to the insurer

Consistency beats vigilance spikes.

Conclusion

The IRDAI 1600 series insurance calls rule gives consumers a clear edge—if they use it correctly. Treat the number range as a quick filter, not blind trust. Verify independently, refuse pressure, and remember: real insurers want you safe, not rushed. With one simple pattern in mind, most fake calls lose their power instantly.

FAQs

What are IRDAI 1600-series insurance calls?

Standardized numbers insurers must use for outbound customer calls.

Does a 1600 number guarantee a call is genuine?

No, but it’s a strong first-level verification signal.

Can insurers still use mobile numbers?

They should transition to 1600-series for customer calls; verify any exceptions.

What should I do if a caller asks for OTPs?

Hang up immediately—no genuine insurer asks for OTPs on calls.

How does this improve customer safety?

It reduces spoofing, improves traceability, and makes scams easier to spot.