The January 2026 money rules India aren’t loud—but they’re costly if you miss them. These are the kinds of changes that don’t trend on social feeds yet quietly affect how much you pay, when transactions fail, and why deductions or charges suddenly appear. If you only react when something breaks, you’ll pay more in fees, lose time, or miss benefits.

This is a practical, no-noise checklist focused on credit cards, PF, tax, and banking changes that influence everyday money from day one of the year.

Why January Is When Money Rules Hurt the Most

January resets systems. Banks, employers, tax platforms, and card networks roll changes simultaneously. That’s why the January 2026 money rules India matter more than mid-year tweaks.

What makes January risky:

-

Auto-updates go live overnight

-

Old limits and exemptions expire

-

Employers apply new payroll logic

-

Platforms enforce compliance without grace

If you don’t adjust settings, the system adjusts you.

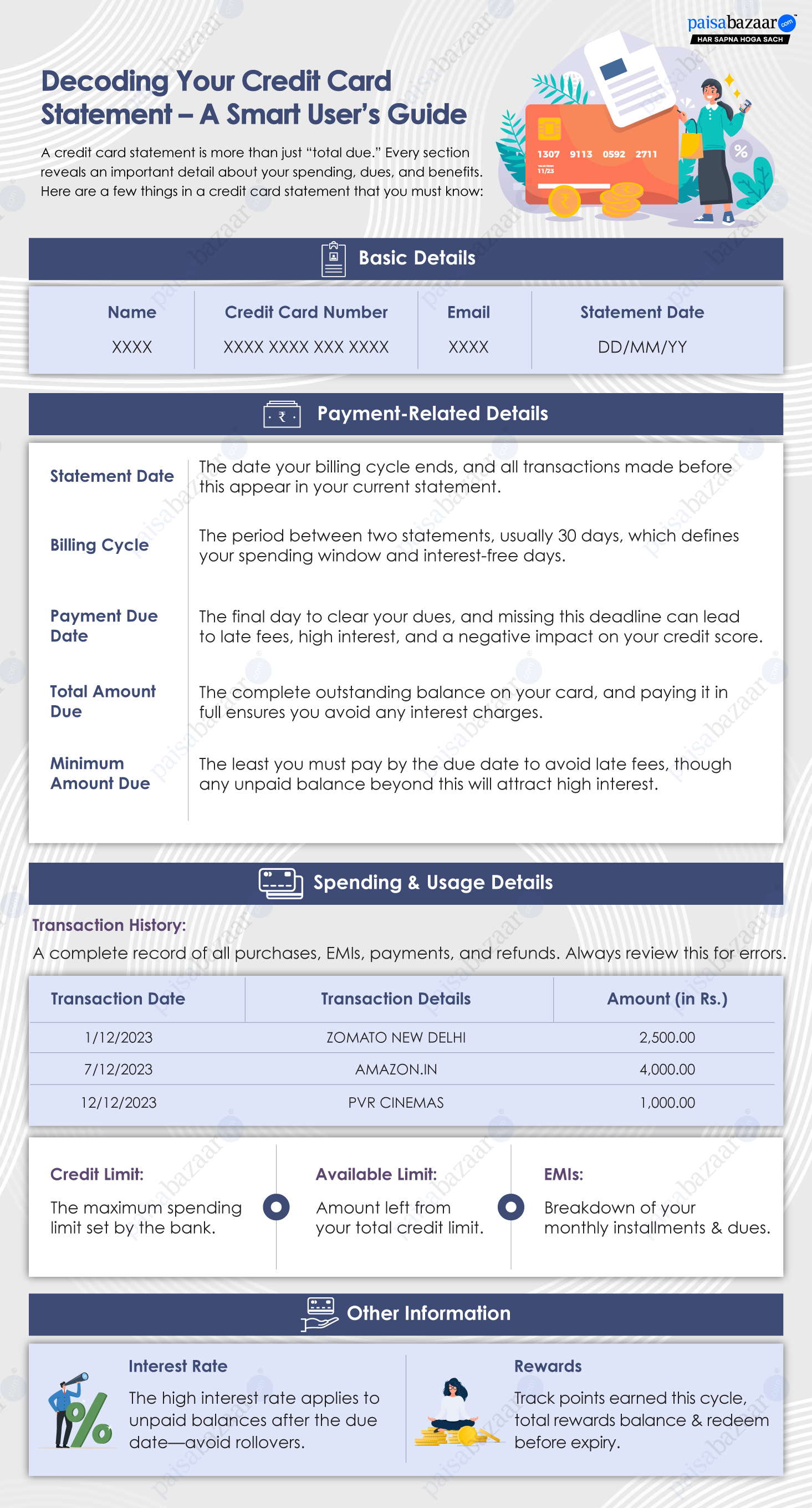

Credit Card Changes That Affect Daily Spending

Credit cards are often the first place people feel friction.

Watch for:

-

Revised interest calculations

-

Updated reward eligibility rules

-

New merchant category exclusions

-

Tighter EMI conversion thresholds

Small line items—late fees, minimum due rules—create outsized costs if ignored.

Banking Changes That Alter Transaction Flow

Banks implement backend changes that surface as “technical issues.”

Common impacts:

-

Stricter verification for large transfers

-

Updated transaction limits

-

New consent prompts for third-party apps

-

Faster blocking on anomaly detection

These banking changes are designed for safety—but they punish outdated settings.

PF and Salary Deductions: What Employees Miss

Payroll systems flip to the new year cleanly—even if you don’t.

Check:

-

PF contribution calculations

-

Voluntary PF settings

-

Salary structure changes applied by HR

-

Carryover of declarations

If you don’t re-verify, deductions may not match your intent.

Tax Rules That Affect Cash Flow Immediately

Not all tax changes wait until filing season.

Immediate effects include:

-

Updated TDS thresholds

-

Revised advance tax calculations

-

Linking and compliance enforcement

-

Interest computation changes

Cash flow gets hit before refunds or adjustments catch up.

Auto-Debits and Standing Instructions to Review

January is when dormant auto-debits wake up.

Audit:

-

Old subscriptions

-

Insurance renewals

-

EMI schedules

-

Utility mandates

The January 2026 money rules India environment is unforgiving to forgotten mandates.

KYC and Compliance Tightening

Compliance isn’t optional—and systems enforce it silently.

Expect:

-

Re-verification prompts

-

Temporary blocks until completion

-

Reduced limits for partial KYC

Do it proactively to avoid transaction failures at the worst time.

What to Do in the First Week of January

A short action list saves months of annoyance.

Do this:

-

Review bank and card notifications

-

Update app permissions and limits

-

Recheck salary and PF slips

-

Cancel unused auto-debits

Thirty minutes here prevents hundreds in leaks.

Mistakes That Cost the Most

Avoid these common traps:

-

Ignoring “policy update” emails

-

Assuming old limits still apply

-

Waiting for failures to react

-

Skipping re-verification prompts

Silence usually means the rule already applied.

How to Build a Personal January Money Checklist

Make it repeatable.

Your checklist should cover:

-

Cards (fees, rewards, limits)

-

Banks (limits, alerts, consents)

-

Salary/PF (deductions, declarations)

-

Tax (TDS, compliance status)

Reuse it every year. The rules will keep changing.

Conclusion

The January 2026 money rules India don’t aim to confuse—but they do assume attention. If you skim updates, you’ll feel the impact through fees, blocks, or missed benefits. Treat January as a financial systems check, not a resolution month. The payoff is quieter, cheaper money management all year.

FAQs

Why do money rules change in January?

Systems reset at the start of the financial year cycle for banks and employers.

Which areas are most affected?

Credit cards, banking limits, PF deductions, and tax-related cash flow.

Do these changes apply to everyone?

Yes, though the impact varies by usage and compliance status.

How long does it take to adjust settings?

Usually under an hour if done proactively.

What’s the biggest mistake people make?

Ignoring update notifications and reacting only after failures.