The RBI digital banking directions 2026 mark a decisive shift in how online and net banking actually works for customers—not just on paper. For years, security upgrades arrived as pop-ups and advisories that users clicked past. This time, the changes harden the system itself: tighter consent rules, clearer responsibility lines, and real consequences for lapses. If you use banking apps daily, you’ll feel the difference in permissions, alerts, and dispute handling.

This isn’t about adding friction for fun. It’s about shrinking the blast radius when things go wrong—and making banks accountable when they do.

Why RBI Issued New Digital Banking Directions

Digital fraud scaled faster than controls. That’s the blunt truth. The RBI digital banking directions 2026 respond to:

-

Rising account-takeover incidents

-

App-level permission abuse

-

Delayed dispute resolution

-

Weak audit trails across vendors

The regulator’s goal is simple: fewer silent failures, faster fixes, and clearer ownership.

What Changes for Customers Day to Day

Most users won’t read the circular—but they’ll notice the outcomes.

Expect:

-

More explicit consent prompts

-

Fewer blanket permissions

-

Clearer transaction alerts

-

Faster acknowledgement of complaints

These aren’t cosmetic updates. They change how data moves and who’s responsible when it leaks.

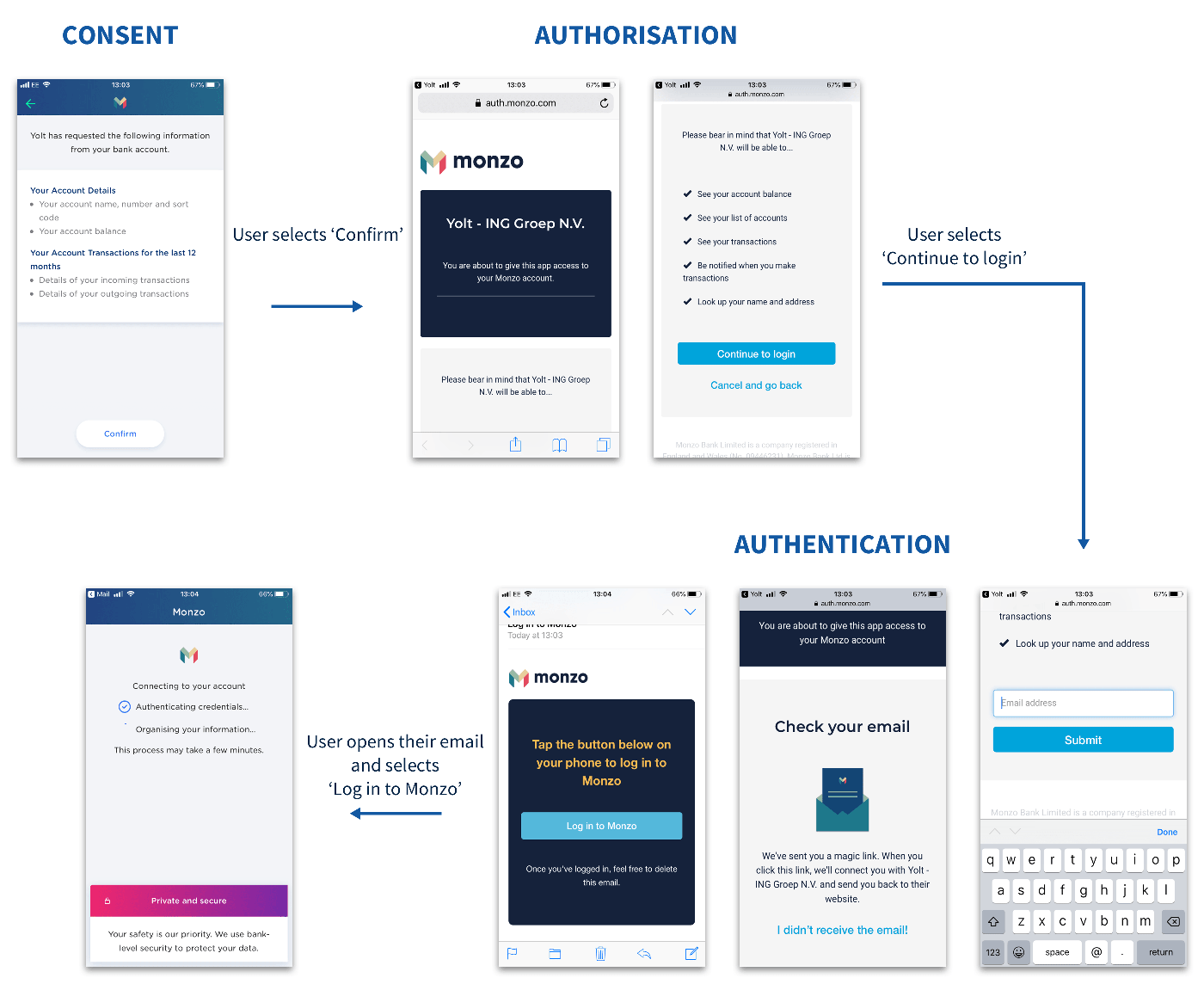

Consent Rules: From “Allow All” to Purpose-Based Access

The biggest shift is consent granularity.

Under the new consent rules:

-

Apps must request access for a specific purpose

-

Permissions can’t be open-ended

-

Users must be able to revoke access easily

-

Re-consent is required after material changes

This curbs “set it and forget it” permissions that quietly expose data.

Cybersecurity Gets Operational, Not Advisory

Banks can no longer treat cybersecurity as a checklist item.

What’s different now:

-

Continuous monitoring requirements

-

Mandatory breach reporting timelines

-

Stronger vendor and API controls

-

Regular resilience testing

If an incident happens, silence is no longer an option.

Bank Accountability Is Finally Clearer

One of the most practical wins is accountability.

The RBI digital banking directions 2026 tighten:

-

Responsibility for third-party failures

-

Timelines for customer communication

-

Interim relief during investigations

-

Documentation for dispute outcomes

Customers shouldn’t have to chase five departments to get answers.

What Happens When There’s a Fraud or Error

The new framework focuses on response, not blame.

Customers can expect:

-

Faster complaint acknowledgment

-

Clear status updates

-

Defined escalation paths

-

Time-bound resolution steps

This reduces the “black hole” feeling after reporting an issue.

How Third-Party Apps Are Affected

Fintechs and aggregators feel the squeeze first.

Impacts include:

-

Stricter onboarding with banks

-

Reduced data access scopes

-

Higher compliance costs

-

Better audit visibility

That’s good for users—even if some features disappear.

What Users Should Do to Stay Ahead

You don’t need to be an expert—just deliberate.

Best practices:

-

Review app permissions quarterly

-

Revoke access you don’t recognize

-

Enable all transaction alerts

-

Save complaint reference numbers

Small habits align you with the new protections.

What These Rules Do NOT Change

Let’s kill the myths.

They do not:

-

Eliminate digital banking

-

Slow normal transactions

-

Require constant manual approvals

They target misuse and opacity—not convenience.

Why This Matters Beyond Banking Apps

Digital banking is the spine of payments, investing, and credit.

Stronger rules mean:

-

Safer integrations

-

Cleaner data flows

-

Better trust in digital finance

That’s systemic, not superficial.

Conclusion

The RBI digital banking directions 2026 move digital finance from “trust us” to “prove it.” By tightening consent, enforcing cybersecurity, and clarifying accountability, the rules shift power slightly back to users. You may tap one extra approval now and then—but you gain clarity when it counts.

Security that works quietly is still security. And this time, it’s enforceable.

FAQs

What are the RBI digital banking directions 2026 about?

They strengthen consent, cybersecurity, and accountability in online banking.

Will I see more permission prompts?

Yes, but they’ll be purpose-specific and revocable.

Do these rules slow down transactions?

No. Routine transactions remain fast.

How do they help during fraud cases?

They enforce faster communication and clearer responsibility.

Do third-party apps lose access?

Some broad access is reduced, improving overall safety.